A career in one of the public Texas universities is bookended by two important decisions. At the beginning, one must decide between the ORP defined contribution and the TRS defined benefit retirement plans. For those who choose TRS, naming a beneficiary is one of the most important things you can do. Death benefits are part of your plan from the first day. Keep in mind, these are not insurance benefits. This means any benefit paid out would be subject to federal income taxes. It is equally important to review beneficiary designations periodically, especially after a major life event.

Retirement comes with yet another decision: how to structure one’s benefit.

The Options

If you are approaching retirement under the TRS system, then you have 23 distinct options from which to choose. Yes, 23 options! Fortunately, the options boil down to a few key decisions:

Decision 1: Single vs. Joint Life

One study from 2003 found that 28% of men and 69% of women opt for single life annuities on retirement. A single life annuity will provide the highest monthly payment amounts, but those payments stop entirely on the death of the recipient.

For a reduced monthly benefit, you could choose a joint life annuity which would continue to pay until the death of the second spouse. In cases where the spouse has a similar or longer life expectancy than the retiree, the joint annuity offers far superior protection. Because many of our newly retired clients are married to people of a similar age, we nearly always see better results from the joint life annuity option.

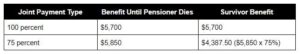

The joint life option comes in several flavors, including the 100%, 75%, and 50% joint life payments. The options represent the percentage of the initial payments the surviving spouse would receive. The initial benefit amount rises as this survivor percentage ratchets down. For example, if Paula the professor chooses the 75% joint life payout option, her initial payment will be higher than it would be if she chose the 100% joint life payout option, but her spouse will receive a lower payment upon her passing.

Important Note – The joint lives do not need to be spouses! For example, a retiree could name a partner or a child as the joint life. Doing so impacts the monthly payout amount and limits the options, if the beneficiary is more than 10 years younger than the retiree. The benefits handbook describes these options in detail.

Decision 2: Guaranteed Payments

What happens if you were to retire, only to get hit by a bus the next day? To make the hypothetical situation even more morbid, what if your spouse (or alternate beneficiary) were to get hit by the same bus? If you elected an annuity option in this example, the payments would cease and the entire retirement plan would have zero value.

A guaranteed payment option, which can be layered on top of the joint survivor annuity options discussed above, can offer some protection to the family against such misfortune. In exchange for a lower monthly payment, you can set a minimum number of payments, which will pay out whether you are alive or not. For example, you could choose payments guaranteed for 60 or 120 months from the retirement date. Should you die before that minimum number of months, payments would go to the named account beneficiaries.

In our experience, this is generally not a worthwhile option. We see annuities as a form of “longevity insurance.” An annuity is the money that will be there when all other resources have been exhausted. This is why we generally favor protecting long-term cash flows over protecting shorter-term payment guarantees.

It might make sense if the couple is facing terminal illnesses or has some other financial obligation, such as a special needs child, where resources might be needed right away.

Decision 3: Lump-Sum Payment

A more extreme version of the guaranteed payment option, a lump-sum payment allows one to “cash in” a portion of the annuity immediately. Doing so provides a short-term cash boost, but then reduces the monthly cash flows for life.

We like the lump sum payment option even less than the guaranteed payments option. That said, like the guaranteed payments option, some very specific short-term financial considerations may make a lump sum the preferred choice. If you are interested in learning what situations might warrant a lump-sum payment, please contact us.

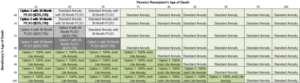

Eliminating Options

We like to build a grid to show clients the implications of taking one version over another. Along one axis is the lifespan of the retiree, while the second axis represents the lifespan of the beneficiary. We then fill in the grid with the highest possible payment option for each combination of lifespans. Interestingly enough, many of the 23 available options are NEVER the best choice.

The example below shows how this could be done.

For the example client above, the single life and the 100% joint life annuities turned out to be the highest paying for most circumstances. As might be expected, some of the guaranteed options performed better in cases where the retiree and beneficiary die earlier than expected.

Making a Choice

We made the point earlier, but it bears repeating, that we treat retirement annuities and Social Security as a form of longevity insurance. From our perspective, the worst possible outcome for a retiree is to outlive their money. As a result, for us at least, the goal for the TRS plan is to ensure cash flows continue for life and that those cash flows be as big as possible. Looking at the annuity from this perspective, we generally avoid the guaranteed payout options, and we usually recommend the 100% joint life option where there is a beneficiary of similar age.

Of course, all circumstances are different. A terminal illness or a short-term financial obligation would completely change the recommendations.

Given how big the decision is, the best course of action is to build a grid like the one depicted in this article or something similar, and then have a detailed discussion as a family to determine the best fit for everybody. At Briaud, we are university retirement experts. If you need assistance picking out the right TRS pension payment option for you, please reach out to us.