You’ve accepted your voluntary separation package, packed up the remnants of your storied academic career, and stepped off the campus for the last time as a professional.

Ahead of you lies a future filled with the possibilities of someone who may not yet have been ready to perform in their last act on this stage. In our last blog, we talked about the emotional and pragmatic considerations of reaching this precipice. Now, with nothing but opportunity ahead – and a mind swirling with ideas, plans, and next steps – it’s time to make sure your financial future is equal to the task.

Whatever familial or professional aspirations beckon, one thing is true today: You’ve accepted a package which certainly includes a finite amount of compensation, likely includes some health insurance for you and your partner – and that’s it.

So, how do you make that package work for you? Particularly, how do we make those resources last the longest, mitigate the tax ramifications of the lump payment, and set yourself up for that bold future ahead?

The good news for those in the academic profession: You have an expanded variety of options to cut taxes, invest wisely, and make your buyout work over time.

In this blog, I hope to introduce you to some common ways that we can help make that happen.

Tax Mitigation

You’ve likely been offered a lump sum of up to a year’s worth of your annual income, and it will be paid concurrent with the salary you earned in your final year of work. Without proper preparation, this windfall can create a massive tax liability for you in the upcoming year. Fortunately, you have some great options to shelter that income from the government’s hands.

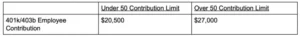

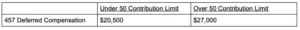

First, as an academic employee, you likely already know you have the 403b retirement and 457 deferred contribution plans – which allows for healthy contributions under normal circumstances but adds extra savings power for those over 50 and/or within three years of retirement. In some cases, you can take advantage of the “super catch up” which will allow you to stockpile an extra $3,000 in your 403b (if you’ve been with the institution for 15 or more years) and a total of $41,000 in your 457 if you’re three years away from retirement.

Here’s how this looks in practical terms, for the 403b:

And, with the 457:

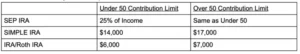

Of course, if you have consulting income on top of your salary and buyout, you can create a SEP to defer a portion of that income as well. One caution – you likely won’t want to do a Roth IRA conversion at this time, but you’ll want to work with your tax planner to maximize Roth conversions over time after your high income years, especially if you retire before age 72, the mandatory distribution age.

Here’s what the totality of the IRA picture looks like:

One note: SEP IRAs do not require any employee contribution, so for professors with consulting income, this is a great way to put away additional money up until their tax return is filed —even past year end.

One vehicle not listed above, the Solo 401k, allows professors to contribute the $27,000 employee plus 25% of income, if they have enough consulting to do this. But, you cannot contribute the employee part to both a 403b and a solo 401k, so this works quite well for someone who has gone part time, is just consulting, or has “unretired.”

Income Right Now

If you anticipate needing access to the income in the coming years through regular distributions, you still may want to consider using the tax deferred vehicles if the payout is coming at the end of the year. Moving taxable income scheduled for December into January can significantly reduce your taxable income. One note – if the VSP payout is due to you prior to the end of the calendar year, you can defer it using retirement vehicles or you may simply ask to see if there’s any “wiggle room” to put off the payout until January 1 of the year that follows, to minimize the tax hit.

Another benefit of shifting your payout may seem counterintuitive: You actually don’t want to have a “zero” tax liability in the year that follows. Consider that it would be quite inefficient to pay taxes at a high bracket like 37 percent one year, and zero the next year. If you are getting a large flow of income, spreading the tax burden into a second year will reduce your tax liability substantially in BOTH years. We call it “relocating” the high-cost dollars into a lower-cost bracket.

Future Considerations

Showing an abnormally high level of income in one year could have effects that stretch beyond tax liabilities. That’s because the government determines your wealth on return data only, and will use that multiplier to compute things like Social Security payouts and future Medicare rates. Note that if you do end up with a very high-income year and a high Medicare bill, you can complete a Medicare Challenge with Social Security and possibly get that income adjustment reduced to what your taxable income should be going forward.

With tax mitigation plans in place, you can now look at additional investment vehicles that fit your level of risk and your time horizon. Whether it’s the need for an ongoing monthly stipend, or to fund future business plans, or to ensure you have enough of an estate to pass along to future generations, you’ll have a variety of options that can help you live your next chapter in relative comfort.