In a recent post, we covered the CARES Act and how that impacts taxpayers in 2020. In this article, we want to do a deep dive into one of the most significant tax benefits for the retirees, the suspension of Required Minimum Distributions (RMD) in 2020.

For those over 70 ½ and retired (the Secure Act pushed this age to 72 for those retired after 12/31/19), you must take an annual distribution from your retirement accounts — IRA, 403(b), 401(k) — that is determined by your balance at the end of the previous year. With the sudden drop in the stock market associated with the COVID 19 virus, the government passed a bill suspending the distribution requirement for 2020 (a similar measure passed in 2009 at the height of the Great Recession).

For those who do not need to make a withdrawal from their retirement accounts this year, there is a tremendous tax planning opportunity. When doing tax planning, our goal is to lower your overall taxes, which in some years means creating taxes. This is especially true in years with lower-income expected. 2020 might be one of those years! Let’s look at a hypothetical example.

How the Required Minimum Distribution Suspension Can Help with Tax Planning

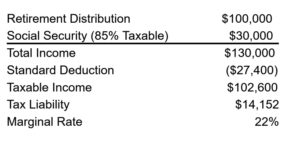

Elaine and Fred, who retired from Texas A&M University ten years ago, have a combined annual RMD of $100,000 each year. In addition to their RMD, they receive $35,294 of Social Security income.

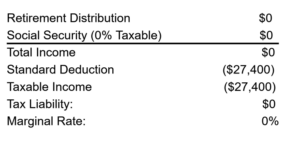

With the RMD suspension, their income is scheduled to be as follows:

At first glance, it appears that Elaine and Fred did an excellent job of tax planning. Who could argue with the results of $0 liability?

However, we know that starting in 2021, Elaine and Fred will once again be in the 22% tax bracket due to their Social Security and RMD income.

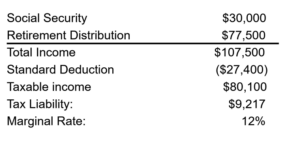

To take advantage of their lower-income, due to the RMD suspension, we would likely recommend creating taxes, albeit at a lower rate.

The goal of tax planning around retirement distributions is to withdraw the funds at the lowest tax rate possible. You may have a unique opportunity to save taxes in the long-term by paying some tax in the short-term.

By making a withdrawal this year, Elaine and Fred saved ~$7,750 in future taxes. The $77,500 withdrawal now is taxed at 12% rather than the 22% bracket (or higher) later.

Supercharging Tax Savings

To supercharge the tax savings, in most cases, we would recommend a Roth Conversion when tax rates are lower. The Roth Conversion allows you to withdraw money from your Traditional IRA, 403(b), or 401(k), and then put the funds into a Roth IRA, which will grow tax-free for the rest of your life (and that of your spouse, if married).

For those who do not need the required minimum distribution in 2020, the RMD suspension is a great tax planning opportunity waiting to be explored. The ability to pay less in taxes and have them grow tax-free is worth serious consideration in 2020.

Understanding IRAs and Roth IRAs

As shown above you may have a unique opportunity in 2020 either because of the required minimum distribution suspension or because you are earning less compared to previous years. Whatever the reason, if your income is down this year, it is worth evaluating whether a Roth conversion would be a good idea for you.

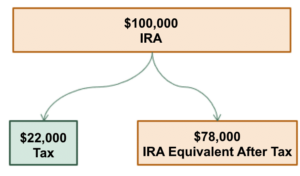

To explain this clearly, we are going to start from the beginning and define what an IRA is and what a Roth IRA is. We will begin with the IRA (although this would apply to any tax-deferred account). The IRA is composed of two parts, your money and the government’s money. Below is an example of someone in the 22% tax bracket.

In an IRA, when you earn a 5% return, so does the government. If the IRA above grows to be worth $105,000, then $81,900 is your money and $23,100 in taxes owed.

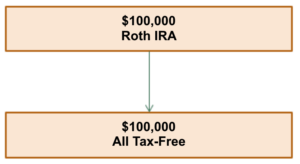

In contrast, a Roth IRA is all your money. So, when it earns 5%, you keep all of the earnings.

So, why wouldn’t everyone put their money in a Roth IRA instead of an IRA? The reason is taxes today. A Roth IRA is not tax-deductible. That means that you have to pay taxes on that money today. If you make a Roth IRA, Roth 401(k), or Roth 403(b) contribution, then you still have to pay taxes on that money even though it is being saved for retirement. In contrast, an IRA, 401(k), 403(b) contribution that is tax-deferred reduces your tax bill today, but it requires that you pay taxes on that money plus its earnings when you take it out of the account.

What are Roth Conversions?

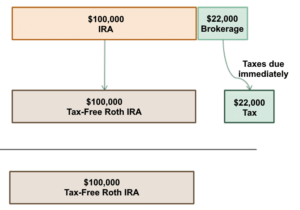

In simple terms, a Roth conversion is taking money out of a tax-deferred account, typically an IRA, and moving it into a Roth IRA. As seen below, you can roll the entire IRA balance into a Roth IRA and use non-retirement money to pay the taxes. This transaction removes the IRS by paying them what they are owed and replaces “the government’s money” with your own money to grow tax-free going forward.

The downside of distributing tax-deferred money to add to a Roth IRA is that the entire distribution is taxable. This is why it is advisable to do so when your income is low.

So, why wouldn’t you want to do this? There are many reasons, which is why you can feel free to discuss a Roth conversion with us before making such a move.

One common reason is that you might want to give the IRA to charity. When you are over 70.5, you can give up to $100,000 per year to charity from your IRA and not pay any taxes. The money is not taxed going in and when given to a charity, it is not taxed coming out— win-win.

Another reason not to do this is if the conversion would put you in a higher tax bracket and you don’t have enough time to recover the difference in taxes from the tax-free gain.

Does it Make Sense for You?

In many cases, it will make sense for an individual to take a required minimum distribution from their retirement accounts in 2020, even though they are not required to do so. Each recommendation is as unique as the clients we serve. If you are interested to learn whether taking a distribution in 2020 makes sense for you, reach out to us. Saving money on taxes is one thing about which we seem to be able to agree.