Are you retiring and signing up for Medicare? A Premium Challenge may be just what the “doctor” ordered for your finances.

If you are in this situation, you are probably being bombarded with “information” on Medigap policies and Advantage plans (often referred to as Medicare Part C, however it is provided through insurers). Of course, this is an important decision you will need to make. However, another factor to consider as you retire that gets little mention – What will your actual Medicare premiums be?

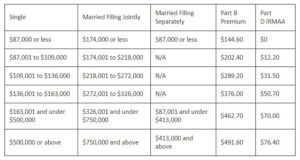

If you are age 65 or older and retiring this year, you will need to sign up for Medicare Parts A (hospital coverage), B (medical insurance) through the Social Security Administration. You will also need to sign up for part D (prescriptions). This will be done through an insurance provider. Medicare part A is free. The standard Part B premium for 2020 is $144.60 for participants with income up to $87,000 for individuals and $174,000 for married couples, and Medicare Part D varies by insurer. However, if you have higher earnings, you will be charged an income-related monthly adjustment amount (IRMAA) by Medicare for Parts B and D, as shown below.

Calculating Medicare Premiums

To calculate your premiums, the Social Security Administration (SSA) uses the modified adjusted gross income (MAGI) from the most recent tax return the IRS has provided them. For 2020, that is most likely your 2018 tax return that was filed in 2019. For 2021, that would likely your 2019 return. MAGI is the total of your adjusted gross income plus any tax-exempt interest you received.

As you can see, higher incomes can cause your Medicare premiums to be increased due to the Income Related Monthly Adjustment Amount by $70.00 up to $423.40 per month. That’s $840 to over $5,000 annually. Total premiums ranging from approximately $2,600 to $6,800 per person annually.

At this point, you are probably thinking, “OK, but my income will be lower in 2021 due to my retirement. Do I still have to pay the higher premiums?” This is where the Medicare Challenge comes in. The Social Security Administration will consider adjusting your Medicare premiums if your income will be lower due to one of the following life-changing events.

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employer’s pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employer’s closure, bankruptcy, or reorganization.

Understanding the Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event form

If your 2021 modified adjusted gross income (MAGI) will be lower than your 2019 MAGI due to retirement, you can file Form SSA-44 Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event (link) to request a premium reduction for 2021. Note, however, that if your 2021 MAGI ends up being the same or higher, they will make you pay back any premium reduction you received. Also, note that if you are married and both covered under Medicare, each of you will need to file the form with Social Security. You will also need to provide documentation supporting your projected 2021 and 2022 MAGI. Supporting documentation would include the date of your separation from work/retirement date and a reasonable calculation of your expected income for 2020 and 2021.

As an example, let’s look at Bob and Jane. Bob, a professor, retired at the end of the spring semester, May 31, 2020, and was age 70 at the time. Jane retired several years earlier. He and Jane were covered by the university health plan and did not need to sign up for Medicare until he retired. Their MAGI from their 2018 tax return was $242,495. Using the 2020 premium table, their part B premium adjustment would be $289.20 and $31.50 per month, respectively. For the two of them, the total monthly part B premiums would be $578.40 per month, $6,940.80 annually, and the total monthly part D surcharge would be $63 per month, annually $756.

Assuming Bob and Jane make below $174,000 in 2020, given his retirement in May, by filing Form SSA-44, we can save Bob and Jane $352.20 per month, $4,226.40 total in 2020 (6 months of premiums).

Even though Form SSA-44 asks for your expected income in 2021 and 2022, you will need to file a second Medicare Challenge for 2022 if your 2020 MAGI puts you in a higher bracket than the expected 2022 MAGI would. Social security only takes into consideration one year at a time for a Medicare Challenge.

As such, we filed a second Form SSA-44 for Bob and Jane to adjust their 2021 Medicare premiums. In 2020 Bob had 5 months of salary. Bob had no wages in 2021, which further reduced their income due to the life-changing event in 2020. If we had not filed the second form, the SSA would likely have calculated their 2021 premiums based on the 2019 MAGI, $246,548. That would have resulted in their total 2021 premiums increasing by over $4,000 for 2021, based on 2020 Medicare rates. 2021 Medicare rates will not be available later this month.

This is one of the many ways we help our clients. If you would like to learn more about how we can help you with your financial future, give us a call at 979-260-9771 or click here to schedule your free consultation today.