The pandemic has prompted many Americans to take a different look at long-term care.

Who Knew?

For me, one of the most devastating aspects of COVID-19 was those early months when we continuously heard the increasing number of residents in long-term care facilities becoming severely infected, and on too many occasions losing their lives. The interviews and videos shown on the nightly news were heartbreaking – family and friends on the outside unable to hug or hold the hand of those on the inside.

Those numbers caused me to wonder how many people reside in long-term care facilities and how can we change the way we provide these services to avoid this happening in the future.

According to the Nursing Home Abuse Center, 1.4 million people live in nursing homes. When you include assisted living facilities, hospice, and other sources, it is estimated 1% of our population is receiving long-term care. That amounts to 3.3 million people.

In my search for better ways to deliver long-term care, I found an article on the Health Affairs website, The Big Idea Behind A New Model of Small Nursing Homes. It discusses the issues with large nursing homes and presents an example of how we can deliver care better. If you are interested in this topic, it is worth your time.

What You Need to Know

We tend to think of people in long-term care as the elderly with chronic or terminal illnesses, dementia, or Alzheimer’s disease. However, many people in long-term care are recovering from strokes, crippling diseases, or severe accidents that can happen at any age.

Statistics from the Nursing Home Abuse Center show:

- 15.5% of the nursing home population are younger than age 65

- 16.5% are between 65 and 74, and

- 26.4% between 75 and 84.

Based on these numbers, almost 60% of the nursing home population is younger than 85.

What are Long-Term Services and Supports?

A study by the Department of Health and Human Service — What Is the Lifetime Risk of Receiving Long-Term Services and Supports? — shows 70% of adults who survive to age 65 will develop severe LTSS needs before they die, and 48% will receive some paid care over their lifetime.

Of those requiring paid care, 19% will need it for 1-2 years, 21% will require 2-5 years of care, and 13% will receive paid care for 5 or more years.

So, what are long-term care services and supports? The National Institute of Health defines them as “a variety of services designed to meet a person’s health or personal care needs…. that help people live as independently and safely as possible when they can no longer perform everyday activities on their own.”

These everyday activities are also referred to as activities of daily living (ADLs), and they include bathing, dressing, grooming, toileting, eating, and transferring (getting out of bed and into a chair). The services can be provided in the home, by community-based organizations, in an assisted living facility, or in a nursing home.

As a financial planner, I also know that the costs of long-term care can be financially devastating for an individual or family. And, no matter your circumstances, you need to have a plan for “What if this happens to me or a loved one?”

Planning and Paying for Long-Term Care

Anyone planning for retirement should consider the possibility that long-term care services might be needed in their future and plan for how that care will be provided. As we have seen above, long-term care might be needed before one reaches the age of 65 and can be required for several years.

The costs of paid care can be prohibitive for many families, whether the care is provided in your home, in an assisted living facility, or in a nursing home.

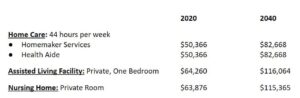

Below are the median annual costs from Genworth’s Cost of Care Survey for 2020.

Home Care: 44 hours per week

- Homemaker Services $53,768

- Health Aide $54,912

Assisted Living Facility: Private, One-Bedroom $51,600

Nursing Home: Private Room $105,850

Costs for nursing home care range from just under $80,000 to over $200,000 per year, depending on where you live. The average cost nationwide for a semi-private room is $7,700 a month, or $92,400 a year. You can check the current costs in your area when you visit the Genworth site. You can also see what costs will be in future years based on annual inflation rates from 1% to 5%. The calculator provides median annual costs.

I used the calculator to check College Station, Texas, median annual costs for 2020 and 2040, assuming a 3% annual inflation rate. Here is what I discovered:

What are the Options for Covering Costs of Long-Term Care?

Medicare: Many people have the misconception that Medicare pays for long-term care. It does pay for short-term residential care if certain conditions are met.

- You had a recent prior hospital stay of at least 3 days.

- You are admitted to a Medicare-certified nursing facility within 30 days of your prior hospital stay (not all facilities are Medicare-certified).

- You need skilled care, such as physical therapy or skilled nursing services.

If you meet ALL these conditions, Medicare pays 100% of the costs for the first 20 days. For days 21-100, you pay your own expenses up to $176 per day and Medicare pays any balance. After 100 days, you are responsible for the entire cost of care for each day you remain in a skilled nursing facility.

Unpaid Care: Due to the high costs of care, many adults who need long-term care are cared for at home by an unpaid family member. This is a heavy responsibility that can have a high cost for the caregiver. These “costs” include stress on their personal relationships and finances, as well as the loss of current or future career opportunities.

Out of Pocket: Those with significant wealth might choose to cover long-term care costs from cash flow or savings. Just remember, for a married couple, in addition to the long-term care costs, you also need to cover living expenses for the spouse. There is also the possibility that both spouses might need care.

Medicaid: Eligibility is based on income and personal financial resources. Requirements vary by state. In Texas, the income limit for the individual applicant is $2,382 per month and countable assets are limited to $2,000. The personal residence and one automobile are not considered countable assets.

If your income or assets are too high, once you have spent down your assets to the required limit, you might qualify for Medicaid coverage. But don’t think that you meet that goal by transferring ownership of your assets. There is a 5-year look-back period, and any money or assets gifted (paid or transferred) to family or friends during the 60 months prior to the application will penalize you from receiving benefits.

The length of the penalty is determined by the amount given and your state’s “penalty divisor.” As an example, say you deeded your home worth $300,000 to your son during the look-back period. Your state’s penalty divisor is $4,000, so this means your penalty period would be 75 months.

Note: Medicaid can recapture the benefits paid for care from the estate at the death of the recipient or, if married, at the death of both spouses.

Long-Term Care Insurance (LTCI): Insurance can be used to pay for care provided at home, in adult daycare, in assisted living facilities and nursing homes, or skilled nursing facilities. Most policies cover costs for modifications to the home that will make it easier to remain and receive care there.

Policies require annual premiums that are based on age, gender, health, and marital status. The cost is also determined by the monthly benefit amount and the benefit period you choose. The maximum benefit you can receive is determined by the daily or monthly benefit amount and the benefit period. Monthly benefits generally fall in the $3,500 to $6,000 per month range. A policy with a monthly benefit of $4,500 and a 3-year benefit period would have a maximum benefit of $162,000. The maximum benefit is the pool of money available to cover the cost of care. If you spend less than $4,500 per month, your benefits last longer. If you only needed $3,000 per month, your 3-year plan would last 4.5 years.

By adding an inflation rider to your policy (for most policies it is 3% or 5%), you increase your benefit and your benefit pool. For the $4,500 benefit above, with a 3% inflation factor, in 10 years the benefit grows to $6,048 per month and the pool to $217,715. In 2020, the average cost of a 3-year plan with a $150/day benefit and 3% inflation rider for a 55-year-old man was $1,700. Premiums for women are generally higher.

When Should You Purchase Long-Term Care Insurance?

You might be asking when is the best time to purchase LTCI? The general consensus is between the ages of 54 and 64. You don’t want to pay premiums longer than necessary, but you also don’t want to wait until you might have health issues that cause you not to qualify for insurance, or be subject to the highest rates. Initial premium rates also increase at a higher rate once you reach age 65.

Pros

- Flexibility – can be customized to fit your needs

- Tax-free benefits

- Premiums might be tax-deductible

- Affordable

- Might qualify for your state’s “partnership” program.

If you have a “partnership policy” (usually requires an inflation factor) and use up all of your long-term care benefits and need to go on Medicaid, in addition to the $2,000 of assets you are normally allowed to keep, an amount equal to the benefits paid out by your long-term care policy is also protected from Medicaid’s asset limit. The protection is also transferrable to other states with partnership programs.

Example: Your policy paid $250,000 of benefits for your care before you needed to apply for Medicaid. With the Texas partnership program, instead of just $2,000you get to keep $252,000 of financial assets – a “dollar for dollar” resource protection.

Cons

- Health requirements for underwriting

- Premiums are not guaranteed and could increase

- You might never need the benefits

For couples, it is often more cost-effective to choose a linked or joint policy.

Linked policies

A policy is purchased for each spouse or qualifying partner and riders are added to the policies that allow the couple to share both benefit pools. Using the example above, each person buys a policy providing a $4,500 per month benefit. By linking the policies, the first spouse to require care can draw from the other spouse’s pool if his or her benefit pool is exhausted. They each would have a benefit pool of $162,000, creating a total pool of $324,000 available, if needed. Adding an inflation rider to the policies would increase the pool, making even more overall funds available if both should require care.

Pros

- Doubles the money available for one of the insured

- Funds are available for both insured if needed

Cons

- All of the cons above apply here, as well

- Requires purchasing two separate policies and riders to link them.

- The first-person needing care could exhaust the entire pool

Joint policy

A single policy that is equally owned by the husband and wife, or qualifying partners. It creates one pool of money to be used by both policy owners. While it is unlikely, both spouses can make a claim and receive benefits up to the monthly maximum until the pool of benefits is exhausted. With a joint policy, you should consider including a higher benefit amount and an inflation rider so that the pool of money remains adequate.

Pros

- Lower premiums due to only one policy

Cons

- If both need care at the same time the amount of insurance purchased might not be sufficient.

Annuities and Hybrid Life Insurance

Both have policies that offer riders you can purchase that will allow you to draw from the policy to cover qualifying long-term care expenses. However, both require large upfront payments or payments over a number of years. Additionally, the more long-term care coverage you want, the deeper your pockets need to be. They might also have a requirement that the policy be in force for a certain period of time before benefits will be paid. If you currently own an annuity or whole-life policy you might be able to trade it for this type of coverage through a tax-free 1035 exchange.

Annuity: A rider allows you to draw benefits to cover costs of care, avoiding any surrender charges that might be in force. The amount you can withdraw is usually a multiple of your normal monthly income stream. With some policies, you pay a lump sum for the annuity and it provides double or triple the premium amount in long-term care benefits for a stated period of time. Distributions for care will reduce the amount of the annuity.

Hybrid Life Insurance: This is a whole-life insurance product that creates a separate pool of money for long-term care expenses, or accelerates death payments to pay for care. The owner can choose a fixed monthly benefit or an acceleration percentage of the policy’s face value (usually 2 – 4%). Benefits paid for long-term care are generally tax-free.

There are some hybrid life insurance policies that have annual premiums, but you will likely pay more for these than you would by buying separate life and long-term care policies.

Pros

- Guaranteed benefits

- Easier or no health underwriting

Cons

- High upfront or ongoing costs.

- Might not provide enough coverage for long-term care needs

- Do not qualify for state long-term care insurance Partnership Plans

Hopefully, we will all stay healthy and never need long-term care. But we need to plan for the possibility. And the best time to plan for long-term care is long before you need it.

Any Questions?

At Briaud, we understand long-term care can be complicated. One of our advisors will be happy to help you understand this topic better. If you have any questions, feel free to call us at (979) 260-9771 or send us your questions via our website.