As part of our comprehensive financial planning services and the initial financial plan, we at Briaud Financial Advisors review our client’s estate documents. These documents include wills, powers of durable and medical attorneys, health care directives, and any trust documents that have been created. Yes, I agree that talking about our mortality is not the most pleasant of topics, however, it is a crucial issue to cover when considering the financial security of your family.

Our Estate Planning Tip? A Chart

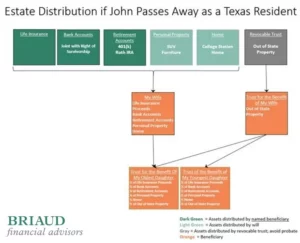

Reading estate documents can sometimes feel like you are reading a whole new language. To be honest, it took me seven years of work, asking many questions and reading dozens of documents, for me to feel comfortable reading wills. A visual chart demonstrating how we believe an estate would be split is a tool we use to communicate and explain what is likely to happen during the estate settlement process.

Below is an overview of the estate chart which I made for myself to help explain my estate documents to my family.

There are some important things that I want to highlight from my chart.

- Retirement and Life Insurance Beneficiaries – These two types of assets transfer by the beneficiary designation and NOT by your will (unless you do not name any beneficiaries). We highly encourage you to verify your beneficiaries on these accounts.

- Bank Accounts – Check with your bank to verify the titling of the bank account.In my case, our accounts are “Joint With the Right of Survivorship,” meaning that when I die, the accounts go directly to my spouse (once again not by will). However, there are different types of titles that require the bank account to go by your will. For example, if the titling is “Tenants in Common,” or “Community Property” it is likely the account will have to go through probate. Depending on your situation, you may want to select one type of titling over another.

- Revocable Trust – I own physical property outside of my home state of Texas.To simplify the estate settlement process, I created a revocable trust which avoids the probate process in the state where the property is owned. If I had not, my executor would have to initiate ancillary (i.e. a separate) probate in the state where the property exists, which would likely cause additional complications and costs, not to mention delays. When I die, the property is then held in an irrevocable trust for the benefit of my wife. The trust allows for my wife to receive income and take withdrawals to support her lifestyle. However, I ultimately want the property to go to my children, and a good way to ensure the property (or the proceeds from a sale) goes to my children is creating an irrevocable trust.

- Trusts For the Benefit of my Children – If my wife and I were to die before my daughters are 25, I implemented language so that my daughters receive the assets within a trust. When they turn 25, the trust ceases, and they have no restrictions on how to use the funds. Before they turn 25, my brother, who serves as the trustee, determines how much can be withdrawn and what the money can be used for.

Why the Estate Planning Chart is Important

When I began the estate planning process, I created a chart similar to the one above assuming I had no will and realized that if I were to pass with no documentation in place, I would be leaving a huge mess for my wife. Plus, in reviewing the situation where both my wife and I died, we would leave a large sum of money (mostly from life insurance proceeds) to my children on their 18th birthdays. The idea of two 18-year-olds with money to burn and no restrictions scared me to death (no pun intended), and it inspired me to take action on my estate documents.

I find the charts we create to be extremely useful as a tool to help outline some basic concepts to clients regarding their estate documents. In my opinion, the chart points out the most prominent issues when creating an estate plan – Who gets what? When does that happen? How much do my beneficiaries receive?

After going through such an exercise, you may find out that you have named a parent, sibling, or ex-spouse as a beneficiary, either directly or indirectly by failing to formalize your intentions. Alternatively, you may find that you have unintentionally left an amount (large or small) to a person or charity with which you are no longer involved. You may realize that you need life insurance because, at your death, you do not leave any money to your loved ones who depend on your income for support. In some cases, we have found that clients came to the decision that they were going to leave TOO much for their children and altered their estate plans.

As part of Briaud Financial Advisors comprehensive services, we would love to discuss your estate and provide you with a personalized chart. Note that we are not attorneys and we rely on their knowledge to verify that our charts are accurate. The goal of your attorney and Briaud is to provide an estate plan that meets your needs so we are more than happy to share our resources with your attorney and work closely with them.

To schedule an initial complimentary meeting, please contact us at 979-260-9771 or reach out to us through our Contact Us page.