A couple walks into my office and sits down. They want to retire. But can they? We start to have a discussion, common to many of my prospective client meetings, about what they have saved.

“Savings? Oh, well that is limited to my 401k and the balance is $500,000.”

Many would think that this is a healthy start to retirement savings. But then we start to total the other side: liabilities.

“Well, we have the following monthly payments:”

- $530 on an RV loan

- $2,034 mortgage payment

- $1,110 home equity line of credit

- $200 on her credit card

- $383 on his truck

- $250 on her car

- $135 on their furniture loan

- $212 on their boat loan

As they share their monthly obligations, I add up the payments. The couple spends $4,854 a month on debt, which is more than $58,000 a year.

I thank them for the payment information and then ask for the real numbers … the balances of those debts and the interest rates on each of them. The clients hadn’t considered that the balances of the loans were important, so they never totaled the amount of debts owed. Here are those figures:

- $50,000 left on the RV loan (6%)

- $305,000 left on the mortgage (4%)

- $50,000 left on the home equity line of credit (6%)

- $20,000 left on her credit card (17%)

- $30,000 left on his truck (2%)

- $20,000 left on her car (1.5%)

- $10,000 left on their furniture loan (4.2%)

- $15,000 left on their boat loan (5%)

In the end, they have a total of $500,000 of debt making their net worth exactly $0. She makes $150,000 per year, which is roughly $9,370 per month after taxes. He doesn’t work. More than half of their income goes to pay off their debt. Nothing was being saved outside of the 401(k).

Sadly, in this situation, it is tough to make a difference as a financial advisor. You just need to save more and pay down debt. Without the debt, a 401(k) balance of $500,000 would be a good start toward retirement.

But, let’s say we could go back in time and catch this couple before some of these purchase decisions. With the principles espoused and practiced at Briaud Financial Advisors, how would we have advised them?

- Every $1 you save amounts to $2 in benefits. First, you have $1 in the bank instead of being $1 in debt. Second, you need less in retirement because you live within or below your means.

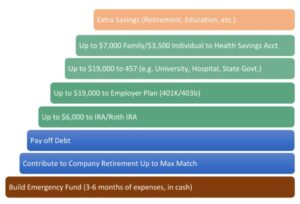

- There is NO wrong way to save, but we find that people are most successful when they save in the following order:

-

- Build up an Emergency Fund: When something goes wrong you want to make sure you don’t have to turn to debt to fill the gap.

- Contribute to Company Retirement Plan Up to the Match: This is free money and a guaranteed 100% rate of return on the amount matched, so there is no reason not to.

- Pay off Debt: This is a risk-free rate of return. If you pay off a credit card that is charging you 17%, you just made 17% by not having to pay it to someone else.

- Save: There are many vehicles after this that allow you to get extra benefit, and it is up to you which works best for you. Here is the list with 2020 contribution limits:

a. $6,000 (+$1,000 if over 50) into an IRA or Roth IRA

b. $19,500 (+$6,500 if over 50) into an Employer Plan (403b/401k/etc.)

i. A SEP or Simple IRA have different limits but are other options from an employer

d. $19,500 into a 457 Deferred Comp Plan – this is offered by universities and other select institutions, which can offer even more deferral opportunities depending on the entity

d. $7,100 into an HSA if you have a health plan that qualifies you and your family for such a contribution ($3550 for an individual)

e. As much as you want into a brokerage or savings account. Keep saving. Only once you have taken care of your financial well-being should you start to think about the well-being of your children.

And for more visual readers, it looks like working your way up these 2020 steps:

Sadly, for this couple, and for most Americans, debt is the major obstacle to financial well-being and eventual retirement. You may wonder why it is not first on this list. The rationale of prioritizing the emergency fund is to prevent the use of additional debt for unexpected expenses. Making use of the company match, if any, is the equivalent of adding to your savings chart above with minimum impact to your cash flow. It would be foolish to pass it up.

There are two major approaches to debt reduction. One involves paying off your highest interest rate debt first and this may be the most financially beneficial approach. The other well-known method is the debt-snowball method, which advocates starting with the smallest debt balances so that you are reducing the total number of creditors/bills. This may be more psychologically beneficial. The choice is personal. The important thing is to choose one of the methods and follow through with it. The longest journey begins with a single step.

On a positive note, the savings component has some snowball effects, too. For example, you’ll need more in your emergency fund until you pay down debt. Once you do, you’ll have more cash for savings and you’ll need less in your emergency fund (reduced monthly payments). So, some of the money in the fund can be reallocated toward a Roth IRA, for example. Once that is funded, more can roll into employer plans, HSAs etc. Every bit counts, and with patience, you’ll see incremental savings really start to add up.

When it does, give us a call and we would be happy to talk about a plan to help you meet your next level goals — whether that is retirement, legacy planning or a bucket list item.